ORDER WITH EXPRESS DELIVERY BY 12PM MONDAY 23RD DECEMBER FOR CHRISTMAS DELIVERY

Finance

Finance at Baker Brothers

Baker Brothers offer comprehensive finance options powered by V12 retail finance to make every step of your Baker Brothers online shopping experience easy.

Our finance options, available in-store or online, allow you to spread the cost of your purchases over £500*. We offer a wide range of payment terms for you to consider from 12 – 60 months, with a *10% minimum deposit.

*Please be aware that finance is subject to age and status, minimum spend applies.

Interest Rates

6, 9, 12 and 24 months = 0% APR (please see excluded products below)

*Minimum spend: £500

*Minimum deposit: 10% of retail price

*Maximum deposit: 50% of retail price

*Please be aware that minimum purchases and deposits can change.

Retail Finance

We offer our customers the ability to apply for simple finance facilities to fund a purchase from us. Once you are accepted by V12 Retail Finance you will be asked to e-Sign the credit agreement. When you have received your purchase, V12 will make your agreement live and your monthly repayments will commence for the agreed term. In short, retail finance gives you the flexibility to buy what you really want now, not just what you can afford today by spreading the cost of your purchase over a repayment period that suits your budget.

Finance is subject to age and status, minimum spend applies. Terms and Conditions apply.

Please note that finance options are not available for Rolex, Sale or Discounted items.

Options Available

Subject to availability, the typical products we offer are:

6 months Interest Free Credit

9 months Interest Free Credit

12 months Interest Free Credit

24 months Interest Free Credit

12 month Interest Bearing Credit at 9.9% APR representative*

24 month Interest Bearing Credit at 9.9% APR representative*

36 month Interest Bearing Credit at 9.9% APR representative*

48 month Interest Bearing Credit at 9.9% APR representative*

60 month Interest Bearing Credit at 9.9% APR representative*

We require a minimum deposit of 10% on all financed products. Representative APR is subject to change, please check the APR before proceeding to the application stage.

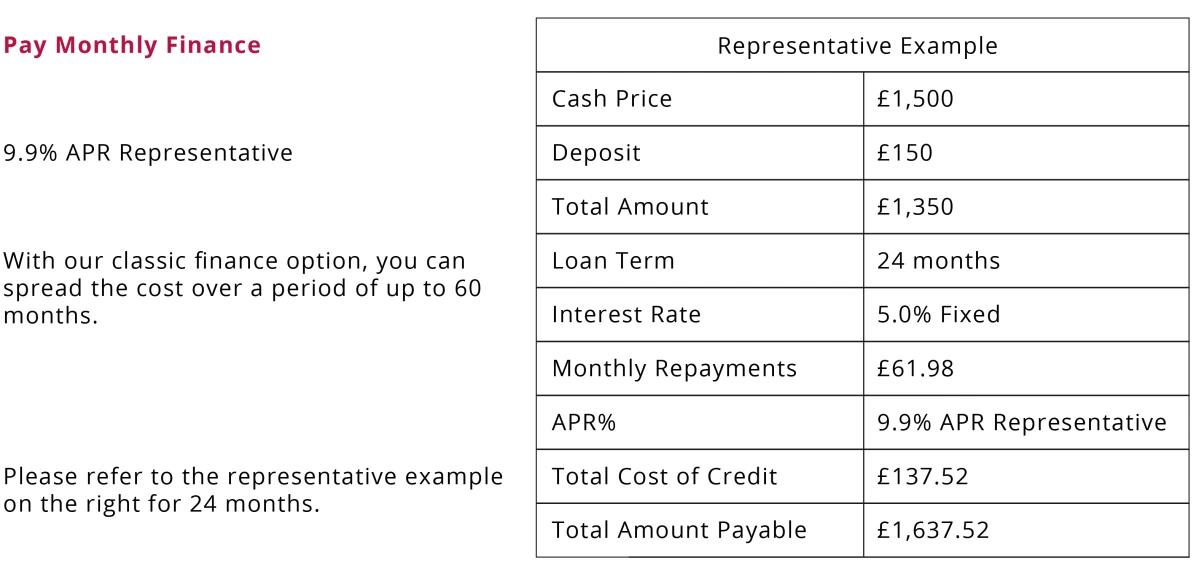

Representative Finance Example

For further information on on the finance products offered by us via V12, please visit their website www.v12retailfinance.com/customer

Product Information

Interest Free Credit

This is an interest free loan with no arrangement fees

You repay the loan amount through equal monthly payments spread over the chosen repayment period

*Minimum loan of £500 applies

Interest Bearing Credit

This is an interest bearing loan with interest charged at the given APR, there are no additional arrangement fees

You repay the loan amount and total interest spread equally over the chosen repayment period

Eligibility Criteria

You must

- Must be aged 18 or over

- Have been a UK resident for 3 years or more

- Have a debit or credit card in your name which is registered to your address, in order to pay the deposit.

- Have a bank or building society current account available (you will need this to complete the direct debit instruction)

- Be in, or your partner is in, permanent paid employment, self-employment, retired or receiving a pension, or a working student in part-time work or in receipt of a disability benefit.

Please note that finance is not available for unemployed individuals. Applications that have previously been rejected should not be reapplied for within a 3-month period.

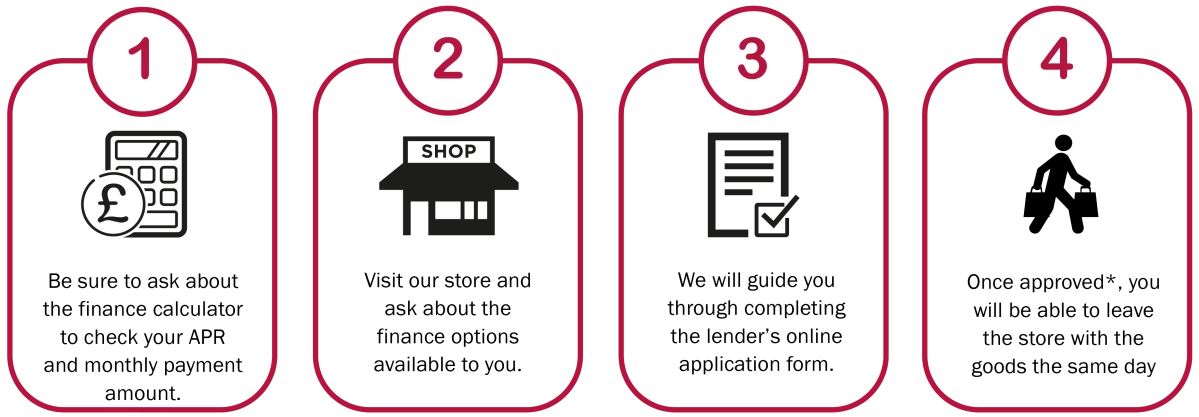

Applying for Finance

Online:

In store:

*Credit is subject to age and status, minimum spend applies. You must agree to the lender’s Terms and Conditions and electronically sign the Credit Agreement document before we can release the goods to you.

Information Required

During the loan application process, you will be asked for your personal information such as;

- Your Full Name

- Address history for the last 3 years

- Date of Birth

- Contact Details

- Employment/income information.

If you are accepted you will also need a credit or debit card registered to you at your address on the credit application so that the lender can carry out an electronic identity check.

Processing Time

With most online applications, we expect that you will be given an acceptance or decline decision within 10 - 20 seconds. In some cases, the lender may return the decision as ‘referred’. You will then receive an email with further instructions once the underwriters have made a decision.

For in-store applications, you can usually wait in the shop whilst the underwriters review your application. Underwriting hours are between 8am and 8pm, Monday to Friday (excluding Bank holidays), 9am and 6pm on Saturday, and 10am and 5pm on Sunday. If your application is referred outside of these hours, then you may have to wait until the next working day for the decision.

Delivery

For finance orders made online, we are only able to deliver the goods to the address on your credit agreement (your home address). You will not be able to have the goods shipped to another address or collect the goods from us in person.

Returns & Cancellation Procedure

If you wish to return the order then please refer to our Returns Policy. If we accept your return, we will contact the lender to cancel the credit agreement.

Please be aware, we may not be able to cancel the finance if the return falls outside of our returns period.

You have 14 days to legally withdraw from any credit agreement you take out with us. The 14-day period begins the day after the date the agreement is made (signed by both parties). Notice of withdrawal can be given in any way and, if you do decide to withdraw, you must repay the credit and any interest that has accrued for the time that you have had the credit within 30 days.

If you decide to cancel your finance agreement for any reason that we do not deem acceptable, we reserve the right to withhold from the refund amount any costs incurred to the business during the cancellation process.

Declined Credit Applications

You will be informed of the decision if the lender declines your application, the lender is unable to share the reason for the decline with us.

Applications are usually declined for reasons such as:

- You do not meet the eligibility criteria (see above)

- Adverse credit reference agency information

- Your credit score

- You are considered to be over-committed, or

- Your existing account performance with other lenders.

The lender will give you the contact details for the credit reference agency used. They will also give you information on how to appeal the decision if you wish to discuss the matter. Please note that the lender is unable to discuss this over the telephone due to Data Protection rules. You should also note that each lender applies its own credit score to applicants so if you have recently been accepted for credit elsewhere this does not necessarily mean that appealing the decision on this basis alone will result in a change of decision.

Terms & Conditions

Please note that these terms and conditions may be amended or updated at any time and without notice. If you have any queries concerning our conditions of service please email [email protected] or call 01234 352343 before placing an order.

The Lender

Baker Brothers (Jewellers) Ltd is authorised and regulated by the Financial Conduct Authority and is the broker and not the lender. Our registration number is 724381. Baker Bros (Jewellers) Ltd offers credit products from Secure Trust Bank PLC trading as V12 Retail Finance. Credit is provided subject to affordability, age and status. Minimum spend applies. Not all products offered by Secure Trust Bank PLC are regulated by the Financial Conduct Authority.

Secure Trust Bank is registered in England and Wales 541132. Registered office: One Arleston Way, Solihull, B90 4LH. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number: 204550.

Baker Bros (Jewellers) Ltd are registered in England and Wales 02163786. Registered office: 4 Beaconsfield Road, St Albans, Hertfordshire AL1 3RD. Authorised and regulated by the Financial Conduct Authority.

Finance FAQs

How long can I take out Finance?

The length of your finance term can range from 6 months to up to 5 years (60 Months) - this will depend on the item and the deposit that you pay. If you need any more information on which finance option, you can choose depending on your chosen item please call (0)1234 352343. We (Baker Brothers) do have the right to refuse any finance application at any point before the item is dispatched.

How do I choose to pay by Finance?

Select the V12 finance option on the checkout website page or let your Sales Consultant know if you are buying in our boutique.

Who is eligible for Finance?

To apply for finance, you must be;

- Over the age of 18

- Work at least 16 hours a week, or be retired with an income.

- You must also be a resident of the United Kingdom and have lived in the UK for the last 12 months or more.

See above for more details.

Will you credit score me and if so, what does this mean?

Credit scoring is the process used by financial services companies to evaluate the credit risk of new applicants. This technique will be applied to your application for online finance. Credit scoring works by awarding points for each answer given on the application form such as age, income and occupation, together with information obtained from credit reference agencies. This information allows us to produce consistent decisions, ensuring all our applicants are treated fairly. Credit scoring does not discriminate on the grounds of sex, race, religion or disability.

When do my repayments start?

Your monthly repayments will begin one month after your purchase has been delivered.

Are there any arrangement fees or hidden extras for credit?

No. There are no arrangement fees or hidden extras.

See above for more details.

My application has been approved, what happens next?

Within minutes of your application being approved, you will be presented with the option to sign your credit agreement. If you are offered the ability to e-sign your credit agreement and choose to do so, a PDF of your credit agreement will be displayed on the screen.

Please read the credit agreement carefully before clicking all the relevant sections agreeing to its terms.

Once you have agreed to the terms of the credit agreement Baker Brothers will be notified and you are required to do anything further.

Please be aware that products will not be allocated to your order until your completed and signed agreement is returned and received by V12 Finance. Shipment of your goods will follow soon after your agreement has been returned to our finance company.

Why has my finance been referred?

V12 should provide a decision within 10 minutes. In a small number of cases, it may take two to three hours to do additional checks. If V12 require further information they will contact you directly. As soon as V12 have reached a decision they will amend the status of your agreement to Approved or Declined.

Why has my finance been declined?

Applications are usually declined for reasons such as:

- You do not meet the eligibility criteria (see above)

- Adverse credit reference agency information

- Your credit score

- You are considered to be over-committed, or

- Your existing account performance with other lenders.

Please see above for more details.

I want to use a different delivery address for my application; can I do this?

No. To safeguard against fraudulent applications, we regret that we are only able to deliver goods to the home address of the applicant.

Which credit reference agencies do you use?

V12 Finance currently report to Experian, Transunion and Equifax. If you have any questions about your credit file you should speak to the credit reference agency in the first instance.

What will show on my bank statement when my direct debit is collected?

When your Direct Debit payment is collected 'V12 Retail Finance' will appear on your bank statement.

How do I cancel my application?

You can cancel your application at any point before you have signed the online documents by calling 02920 468 916. You have the right under section 66A of the Consumer Credit Act 1974 to withdraw from the agreement, without giving any reason, within 14 days from the day after the day on which the agreement is signed by you.

For more information on V12 Finance, please visit their website www.v12retailfinance.com/customer

Updated May 2023

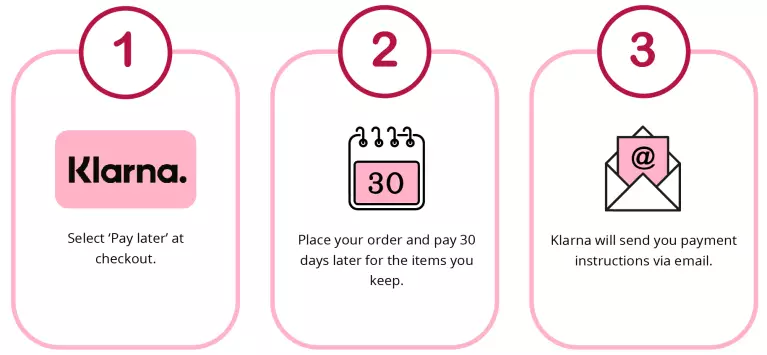

Klarna at Baker Brothers

Choose from two easy payment options; pay in 3 interest free installments or pay 30 days after delivery.

There’s no interest. No fees when you pay on time*. No credit agreement.

How to Pay with Klarna

Pay in 3

Available on orders between £75 - £500, split your payment into 3 equal interest free instalments.

Pay in 30 days after delivery

Available on online orders between £75 - £500, get your order now and pay up to 30 days after delivery.

*Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

To find out more about Klarna, please visit Klarna Support.